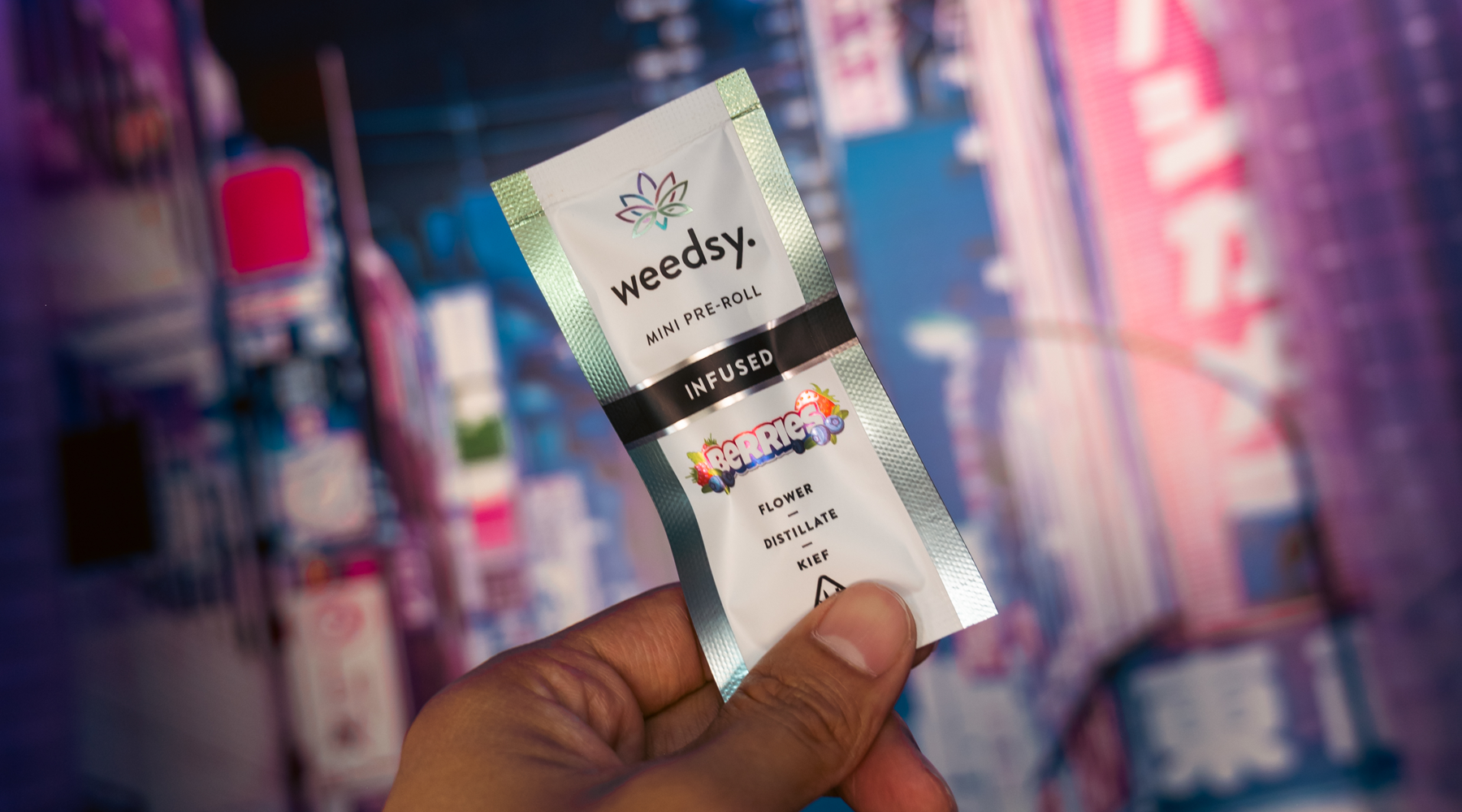

We'd like to think we have a pretty toxic relationship with our good friends over at the California Bureau of Cannabis Control. It's fantastic that we get operate Weedsy, legally, in the state. And it's wonderful to be able to deliver our delicious Infused mini pre-rolls to residents with little to no issue (most of the time). The toxic part, however, stems from the slow rollout of reform, particularly as it pertains to the ridiculous amounts of taxes we need to pay to continue to operate in the state.

Now, this isn't a knock whatsoever. As you can possibly imagine, handling brands, cultivators, manufacturers, and dispensaries alike can be challenging for such as large state; so it's understandable to an extent, the bureaucracy or really, the governor's mood at any given time, can really make or break the relationship dynamic. Luckily, where the state fails to act, a few cities and counties in California have made significant progress in keeping our industry alive through tax relief. These rollbacks mainly reflect lobbying from industry organizations and local residents alike as the black market flourishes unchecked, while also making stoners like you and I pay ridiculously high prices for our favorite cannabis-derived products.

HOW DID WE GET HERE?

Unlike some of the other states Weedsy operates in (shoutout to Oklahoma and Arizona), California stands as one of the most expensive states to do business and live in. Whether it be stupid-high homeowner prices, the cost of gas pushing closer to $6.00 a gallon, or, the most important part - TAXES, the beautiful weather and relatively chill environment really comes at the cost of well, its cost! So how did we get here? How is it that despite California already being a whole thing in terms of operating, get to a point where the legal market struggles to this extent? All of this mainly dates back to Q3 and Q4 2021, where the legal market entered bear territory and the overall demand for cannabis plummeted.

After years of literally going 250 miles per hour, we simply grew way too much cannabis for what was actually in demand. As a result, prices dropped nearly 60% thus bringing the industry to its knees. Compound that with roughly the same tax obligations since the 2016 legalization and a flourishing black market where the typical stoner can get almost the same product for a fraction of the cost and we've found the problem!

You're probably thinking - well, let's just not grow so much cannabis then and the market would correct itself right? This isn't as easy as adjusting output. While we might not be cultivators, we definitely understand that many of these small, craft-batch cultivators do not operate in the same fashion as small vinyards or craft breweries. The cost of operating doesn't scale as linearly as you might think. Should an operation downsize, the industry would then run into the problem of commodification and the destruction of "good weed." This means, exotic flower, which is the flower Weedsy Infused mini pre-rolls consist of, would be harder to source, thus driving the cost up and we'll soon find ourselves in a different pickle altogether.

And while cultivation supply is constantly in limbo, the industry's actors - cultivators and further along the supply chain are taxed the same exact way if it was full steam ahead. The state's cultivation tax, for example, is $161 per pound with a 15% excise tax and whatever other local taxes are at the city and county level. It's simply too expensive to continue as is. Like any resident of any state would do, pressure was placed on the government for reform, and here we are, still twiddling our thumbs waiting for actual, meaningful change.

PATIENTLY WAITING FOR CALIFORNIA TO ACT

After quite literally, 6 years of screaming at the government to nip this problem in the butt, with everyone collectively screaming a little louder over the last 6 months, the state introduced three bills aimed at lessening the tax burden: Assembly Bill 2792, AB 2506, and Senate Bill 1293. While all three should honestly be put together for a more complete solution, SB1293 seems to be the most comprehensive as it'll completely do away with the cultivation tax and reduce the excise tax to 5%. Once again, however, the power of the state bureaucracy shows, in that even IF it's passed, it won't go into effect until 2023 at the earliest.

At this point, we get to the real meat and potatoes of this article. Where California state fails to speed up the legislative process to bring real, meaningful change to our businesses, individual counties and cities are beginning to introduce tax relief. Humboldt County, for example, previously required between $1 and $3 per-square-foot, the amount of which was dependent on the cultivation license type. Now, under the county's Measure S, that tax rate is reduced by 85%, allowing growers to pay only 15% of the total amount.

By temporarily lowering the cultivation tax, the county does two things: first, it shows commitment towards the longevity of the industry. After all, growers have contributed over $50 million to the local economy over the last four years. Second, it dispels the myth that legal cannabis operations are inherently cash cows.

Believe it or not, legal cannabis businesses can be highly profitable, but it's not a guarantee. By dialing back local taxes, businesses can build more of a financial cushion to further reinvest and scale in a more sustainable way.

Given Humboldt County's localized tax break, let's check out some of the other counties and cities that have followed suit.

LOCALIZED TAX RELIEF ISN'T A NEW TREND

Following suit with Humboldt County's Measure S, several other counties and cities have introduced their own tax relief bills over the years aimed at not only keeping the industry alive, but to thrive in a more meaningful way. Besides, what local community wouldn't want a supercharged economy and lower unemployment figures?

Lake County

In January, the Board of Supervisors voted to postpone the due date for cannabis tax payments an suspend the 25% late-payment penalty during the postponement. While this doesn't necessarily "fix" the issue of over-taxation, time is a gift most government officials fail to take into consideration - particularly as market forces may drive down the demand.

Monterey County

The Board of Supervisors voted yesterday, March 1st on an industry-wide tax reduction which includes eliminating automatic tax increases and removing distribution taxes entirely. On top of that, the Board voted to increase the number of times growers can amend the taxable square footage of their operations from once to twice a year. Next to Humboldt County, Monterey County is one of the most densely populated areas that house a lot of the cultivation operations brands like Weedsy and others rely on. By lessening the tax burden and bringing more flexibility to cultivators, businesses can scale more sustainably.

Sonoma County

In January, the Sonoma County Board of Supervisors voted to postpone first-quarter taxes from January 31st to April 30th. Total taxes levied for both quarters will be due without penalties or interest on April 30th unless the board approves another extension.

City of Bellflower

In October 2020, local officials reduced taxes for both manufacturing and distribution from 7.5% to 2% and 1% respectively.

City of Berkeley

In February 2018, local officials reduced the cannabis tax rate from 10% to 5% to remain competitive to the rest of the Bay Area.

Desert Hot Springs

Desert Hot Springs is another cannabis hotspot for both cultivation and manufacturing operations. Back in February 2021, local officials reduced cultivation taxes from $25.50 to $10.20 per pound.

City of Long Beach

Long Beach adopted a multi-sector approach to tax relief. In 2019, the city lowered manufacturing, distribution, and testing tax rates from 6% to 1%. And in 2020, the City Council agreed to ditch a proposed tax increase while also voting to extend the hours of operation for dispensaries and delivery services.

City of Oakland

In 2019, the City Council voted to lower the gross receipts tax on cannabis businesses that make less than $500,000 annually from 10% to 0.12%.

Palm Springs

In February 2019, local officials reduced the manufacturing tax from 10% to 2%.

City of San Diego

Back in February 2022, the San Diego City Council voted to reduce the manufacturing and cultivation tax rate from 8% down to 2%, effective May 1st.

City of San Francisco

In December 2021, San Francisco approved a second one-year suspension of the city's cannabis business tax through 2023.

City of San Jose

In July 2019, San Jose introduced multi-sector tax relief initiative aimed at reducing the flat-rate taxes on cultivation, manufacturing, distribution, and testing. Prior to the new initiative, taxes were at 10% across the board. Under the new scheme, taxes look like:

- 4% Cultivation

- 3% Manufacturing

- 2% Distribution

- 0% Testing

KEEP UP THE PRESSURE AND THE STATE WILL ACT

While these counties and cities have done their part to reduce the tax burden on our industry, there are still large swathes of the state that have not experienced any relief. Keep up the pressure, bug those assembly and senate representatives of yours. The legal cannabis industry is a gift for California residents and it's everyone's job to make sure it exists in the way voters need it to.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.